Page 42 - SWGas Annual Report 2015

P. 42

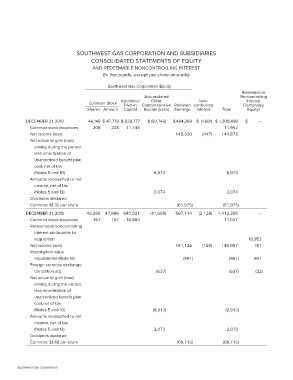

SOUTHWEST GAS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

AND REDEEMABLE NONCONTROLLING INTEREST

(In thousands, except per share amounts)

Southwest Gas Corporation Equity

Accumulated Redeemable

Noncontrolling

Common Stock Additional Other Non-

Interest

Paid-in Comprehensive Retained controlling (Temporary

Shares Amount Capital Income (Loss) Earnings Interest Total Equity)

DECEMBER 31, 2012 46,148 $ 47,778 $ 828,777 $ (50,745) $ 484,369 $ (1,681) $ 1,308,498 $ —

Common stock issuances 208 208 11,744 11,952

Net income (loss)

Net actuarial gain (loss) 145,320 (447) 144,873

arising during the period,

less amortization of 6,973 6,973

unamortized benefit plan

cost, net of tax 2,074 2,074

(Notes 5 and 10)

Amounts reclassified to net (61,975) (61,975)

income, net of tax

(Notes 5 and 13)

Dividends declared

Common: $1.32 per share

DECEMBER 31, 2013 46,356 47,986 840,521 (41,698) 567,714 (2,128) 1,412,395 —

Common stock issuances 167 167 10,860 11,027

Redeemable noncontrolling

interest attributable to 141,126 (129) 140,997 18,952

acquisition 151

Net income (loss)

Redemption value (961) (961) 961

adjustments (Note 16)

Foreign currency exchange (637) (637) (22)

translation adj.

Net actuarial gain (loss) (9,913) (9,913)

arising during the period,

less amortization of 2,073 2,073

unamortized benefit plan (68,715)

cost,net of tax (68,715)

(Notes 5 and 10)

Amounts reclassified to net

income, net of tax

(Notes 5 and 13)

Dividends declared

Common: $1.46 per share

Southwest Gas Corporation