Page 15 - SWGas Annual Report 2015

P. 15

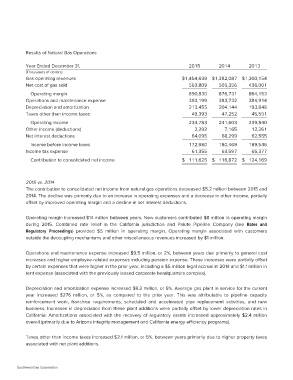

Results of Natural Gas Operations 2015 2014 2013

Year Ended December 31, $1,454,639 $1,382,087 $1,300,154

563,809 505,356 436,001

(Thousands of dollars)

890,830 876,731 864,153

Gas operating revenues 393,199 383,732 384,914

Net cost of gas sold 213,455 204,144 193,848

Operating margin 49,393 47,252 45,551

Operations and maintenance expense

Depreciation and amortization 234,783 241,603 239,840

Taxes other than income taxes 2,292 7,165 12,261

62,555

Operating income 64,095 68,299

Other income (deductions)

Net interest deductions 172,980 180,469 189,546

61,355 63,597 65,377

Income before income taxes

Income tax expense $ 111,625 $ 116,872 $ 124,169

Contribution to consolidated net income

2015 vs. 2014

The contribution to consolidated net income from natural gas operations decreased $5.2 million between 2015 and

2014. The decline was primarily due to an increase in operating expenses and a decrease in other income, partially

offset by improved operating margin and a decline in net interest deductions.

Operating margin increased $14 million between years. New customers contributed $8 million in operating margin

during 2015. Combined rate relief in the California jurisdiction and Paiute Pipeline Company (see Rates and

Regulatory Proceedings) provided $5 million in operating margin. Operating margin associated with customers

outside the decoupling mechanisms and other miscellaneous revenues increased by $1 million.

Operations and maintenance expense increased $9.5 million, or 2%, between years due primarily to general cost

increases and higher employee-related expenses including pension expense. These increases were partially offset

by certain expenses that were higher in the prior year, including a $5 million legal accrual in 2014 and $1.1 million in

rent expense (associated with the previously leased corporate headquarters complex).

Depreciation and amortization expense increased $9.3 million, or 5%. Average gas plant in service for the current

year increased $276 million, or 5%, as compared to the prior year. This was attributable to pipeline capacity

reinforcement work, franchise requirements, scheduled and accelerated pipe replacement activities, and new

business. Increases in depreciation from these plant additions were partially offset by lower depreciation rates in

California. Amortizations associated with the recovery of regulatory assets increased approximately $2.4 million

overall (primarily due to Arizona integrity management and California energy efficiency programs).

Taxes other than income taxes increased $2.1 million, or 5%, between years primarily due to higher property taxes

associated with net plant additions.

Southwest Gas Corporation