Page 29 - SWGas Annual Report 2015

P. 29

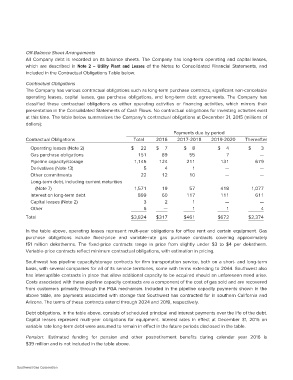

Off-Balance Sheet Arrangements

All Company debt is recorded on its balance sheets. The Company has long-term operating and capital leases,

which are described in Note 2 – Utility Plant and Leases of the Notes to Consolidated Financial Statements, and

included in the Contractual Obligations Table below.

Contractual Obligations

The Company has various contractual obligations such as long-term purchase contracts, significant non-cancelable

operating leases, capital leases, gas purchase obligations, and long-term debt agreements. The Company has

classified these contractual obligations as either operating activities or financing activities, which mirrors their

presentation in the Consolidated Statements of Cash Flows. No contractual obligations for investing activities exist

at this time. The table below summarizes the Company’s contractual obligations at December 31, 2015 (millions of

dollars):

Contractual Obligations Total Payments due by period Thereafter

2016 2017-2018 2019-2020

Operating leases (Note 2) $ 22 $7 $8 $4 $3

Gas purchase obligations 151 89 55 7 —

Pipeline capacity/storage

Derivatives (Note 13) 1,145 124 211 131 679

Other commitments 5 4 1 — —

Long-term debt, including current maturities — —

22 12 10

(Note 7) 418 1,077

Interest on long-term debt 1,571 19 57 111 611

Capital leases (Note 2) 899 60 117 —

Other 3 — 4

6 2 1 1

— 1

Total $3,824 $317 $461 $672 $2,374

In the table above, operating leases represent multi-year obligations for office rent and certain equipment. Gas

purchase obligations include fixed-price and variable-rate gas purchase contracts covering approximately

151 million dekatherms. The fixed-price contracts range in price from slightly under $3 to $4 per dekatherm.

Variable-price contracts reflect minimum contractual obligations, with estimation in pricing.

Southwest has pipeline capacity/storage contracts for firm transportation service, both on a short- and long-term

basis, with several companies for all of its service territories, some with terms extending to 2044. Southwest also

has interruptible contracts in place that allow additional capacity to be acquired should an unforeseen need arise.

Costs associated with these pipeline capacity contracts are a component of the cost of gas sold and are recovered

from customers primarily through the PGA mechanism. Included in the pipeline capacity payments shown in the

above table, are payments associated with storage that Southwest has contracted for in southern California and

Arizona. The terms of these contracts extend through 2024 and 2019, respectively.

Debt obligations, in the table above, consists of scheduled principal and interest payments over the life of the debt.

Capital leases represent multi-year obligations for equipment. Interest rates in effect at December 31, 2015 on

variable rate long-term debt were assumed to remain in effect in the future periods disclosed in the table.

Pension: Estimated funding for pension and other postretirement benefits during calendar year 2016 is

$39 million and is not included in the table above.

Southwest Gas Corporation