Page 34 - SWGas Annual Report 2015

P. 34

forward-looking statements even if experience or future changes show that the indicated results or events will not

be realized. We caution you to not rely unduly on any forward-looking statement(s).

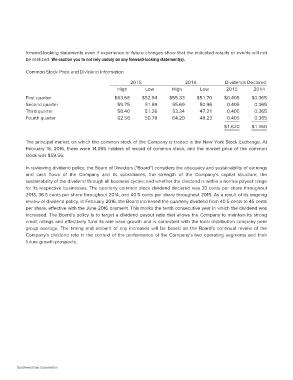

Common Stock Price and Dividend Information

2015 2014 Dividends Declared

High Low High Low 2015 2014

First quarter $63.68 $52.94 $55.33 $51.70 $0.405 $0.365

Second quarter 59.75 51.69 55.69 50.96 0.405 0.365

Third quarter 58.40 51.26 53.34 47.21 0.405 0.365

Fourth quarter 62.56 50.78 64.20 48.23 0.405 0.365

$1.620 $1.460

The principal market on which the common stock of the Company is traded is the New York Stock Exchange. At

February 16, 2016, there were 14,095 holders of record of common stock, and the market price of the common

stock was $59.56.

In reviewing dividend policy, the Board of Directors (“Board”) considers the adequacy and sustainability of earnings

and cash flows of the Company and its subsidiaries; the strength of the Company’s capital structure; the

sustainability of the dividend through all business cycles; and whether the dividend is within a normal payout range

for its respective businesses. The quarterly common stock dividend declared was 33 cents per share throughout

2013, 36.5 cents per share throughout 2014, and 40.5 cents per share throughout 2015. As a result of its ongoing

review of dividend policy, in February 2016, the Board increased the quarterly dividend from 40.5 cents to 45 cents

per share, effective with the June 2016 payment. This marks the tenth consecutive year in which the dividend was

increased. The Board’s policy is to target a dividend payout ratio that allows the Company to maintain its strong

credit ratings and effectively fund its rate base growth and is consistent with the local distribution company peer

group average. The timing and amount of any increases will be based on the Board’s continual review of the

Company’s dividend rate in the context of the performance of the Company’s two operating segments and their

future growth prospects.

Southwest Gas Corporation