Page 49 - SWGas Annual Report 2015

P. 49

amortized over the weighted-average lives of the new issues and become a component of interest expense. See

also discussion regarding Accumulated Removal Costs above.

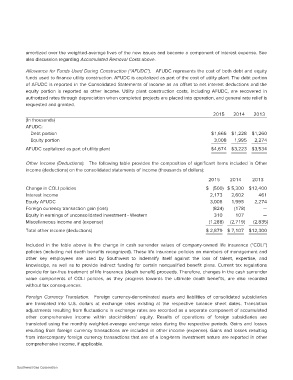

Allowance for Funds Used During Construction (“AFUDC”). AFUDC represents the cost of both debt and equity

funds used to finance utility construction. AFUDC is capitalized as part of the cost of utility plant. The debt portion

of AFUDC is reported in the Consolidated Statements of Income as an offset to net interest deductions and the

equity portion is reported as other income. Utility plant construction costs, including AFUDC, are recovered in

authorized rates through depreciation when completed projects are placed into operation, and general rate relief is

requested and granted.

(In thousands) 2015 2014 2013

AFUDC:

$1,666 $1,228 $1,260

Debt portion 3,008 1,995 2,274

Equity portion

$4,674 $3,223 $3,534

AFUDC capitalized as part of utility plant

Other Income (Deductions). The following table provides the composition of significant items included in Other

income (deductions) on the consolidated statements of income (thousands of dollars):

2015 2014 2013

Change in COLI policies $ (500) $ 5,300 $12,400

Interest income

Equity AFUDC 2,173 2,602 461

Foreign currency transaction gain (loss)

Equity in earnings of unconsolidated investment - Western 3,008 1,995 2,274

Miscellaneous income and (expense)

(824) (178) —

Total other income (deductions)

310 107 —

(1,288) (2,719) (2,835)

$ 2,879 $ 7,107 $12,300

Included in the table above is the change in cash surrender values of company-owned life insurance (“COLI”)

policies (including net death benefits recognized). These life insurance policies on members of management and

other key employees are used by Southwest to indemnify itself against the loss of talent, expertise, and

knowledge, as well as to provide indirect funding for certain nonqualified benefit plans. Current tax regulations

provide for tax-free treatment of life insurance (death benefit) proceeds. Therefore, changes in the cash surrender

value components of COLI policies, as they progress towards the ultimate death benefits, are also recorded

without tax consequences.

Foreign Currency Translation. Foreign currency-denominated assets and liabilities of consolidated subsidiaries

are translated into U.S. dollars at exchange rates existing at the respective balance sheet dates. Translation

adjustments resulting from fluctuations in exchange rates are recorded as a separate component of accumulated

other comprehensive income within stockholders’ equity. Results of operations of foreign subsidiaries are

translated using the monthly weighted-average exchange rates during the respective periods. Gains and losses

resulting from foreign currency transactions are included in other income (expense). Gains and losses resulting

from intercompany foreign currency transactions that are of a long-term investment nature are reported in other

comprehensive income, if applicable.

Southwest Gas Corporation