Page 80 - SWGas Annual Report 2015

P. 80

(a) Construction services segment assets included two liabilities that were netted against gas operations segment assets

during consolidation in 2014. They are: Income taxes payable of $3.3 million, netted against income taxes receivable, net

and deferred income taxes of $1.4 million, netted against deferred income taxes, net. Construction services segment assets

exclude a long-term deferred tax benefit of $1.4 million, which was netted against gas operations segment deferred income

taxes and investment tax credits, net during consolidation. Gas operations segment assets include a deferred income tax

liability of $4.5 million, which was netted against a construction services segment asset for deferred income taxes, net

during consolidation.

(b) Construction services segment assets included income taxes payable of $666,000 in 2013, which was netted against gas

operations segment income taxes receivable, net during consolidation.

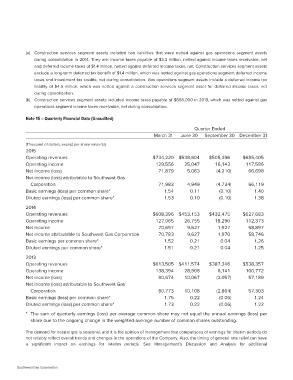

Note 15 – Quarterly Financial Data (Unaudited)

Quarter Ended

March 31 June 30 September 30 December 31

(Thousand of dollars, except per share amounts) $734,220 $538,604 $505,396 $685,405

16,143 117,586

2015 129,556 25,047 (4,210) 66,698

Operating revenues

Operating income 71,879 5,063 66,119

Net income (loss) 1.40

Net income (loss) attributable to Southwest Gas 71,983 4,949 (4,734) 1.38

1.54 0.11 (0.10)

Corporation 1.53 0.10 (0.10)

Basic earnings (loss) per common share*

Diluted earnings (loss) per common share*

2014 $608,396 $453,153 $432,475 $627,683

Operating revenues 127,065 26,755 18,290 112,373

Operating income 70,697 9,627 1,927 58,897

Net income 70,783 9,627 1,970 58,746

Net income attributable to Southwest Gas Corporation 1.52 0.21 0.04 1.26

Basic earnings per common share* 1.51 0.21 0.04 1.25

Diluted earnings per common share*

2013 $613,505 $411,574 $387,346 $538,357

Operating revenues 138,394 28,908 6,141 100,772

Operating income 80,674 10,067 (3,057) 57,189

Net income (loss)

Net income (loss) attributable to Southwest Gas 80,773 10,108 (2,864) 57,303

1.75 0.22 (0.06) 1.24

Corporation 1.73 0.22 (0.06) 1.22

Basic earnings (loss) per common share*

Diluted earnings (loss) per common share*

* The sum of quarterly earnings (loss) per average common share may not equal the annual earnings (loss) per

share due to the ongoing change in the weighted-average number of common shares outstanding.

The demand for natural gas is seasonal, and it is the opinion of management that comparisons of earnings for interim periods do

not reliably reflect overall trends and changes in the operations of the Company. Also, the timing of general rate relief can have

a significant impact on earnings for interim periods. See Management’s Discussion and Analysis for additional

Southwest Gas Corporation