Page 76 - SWGas Annual Report 2015

P. 76

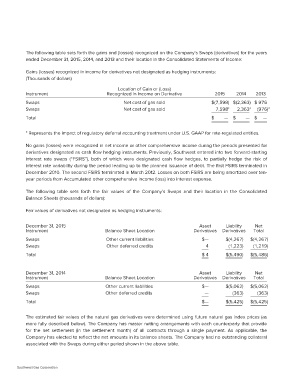

The following table sets forth the gains and (losses) recognized on the Company’s Swaps (derivatives) for the years

ended December 31, 2015, 2014, and 2013 and their location in the Consolidated Statements of Income:

Gains (losses) recognized in income for derivatives not designated as hedging instruments:

(Thousands of dollars)

Instrument Location of Gain or (Loss) 2015 2014 2013

Swaps Recognized in Income on Derivative $(7,598) $(2,363) $ 976

Swaps

Total Net cost of gas sold 7,598* 2,363* (976)*

Net cost of gas sold $ —$ —$ —

* Represents the impact of regulatory deferral accounting treatment under U.S. GAAP for rate-regulated entities.

No gains (losses) were recognized in net income or other comprehensive income during the periods presented for

derivatives designated as cash flow hedging instruments. Previously, Southwest entered into two forward-starting

interest rate swaps (“FSIRS”), both of which were designated cash flow hedges, to partially hedge the risk of

interest rate variability during the period leading up to the planned issuance of debt. The first FSIRS terminated in

December 2010. The second FSIRS terminated in March 2012. Losses on both FSIRS are being amortized over ten-

year periods from Accumulated other comprehensive income (loss) into interest expense.

The following table sets forth the fair values of the Company’s Swaps and their location in the Consolidated

Balance Sheets (thousands of dollars):

Fair values of derivatives not designated as hedging instruments:

December 31, 2015 Asset Liability Net

Instrument

Balance Sheet Location Derivatives Derivatives Total

Swaps

Swaps Other current liabilities $— $(4,267) $(4,267)

Other deferred credits 4 (1,223) (1,219)

Total

$ 4 $(5,490) $(5,486)

December 31, 2014 Asset Liability Net

Instrument

Balance Sheet Location Derivatives Derivatives Total

Swaps

Swaps Other current liabilities $— $(5,062) $(5,062)

Other deferred credits

Total — (363) (363)

$— $(5,425) $(5,425)

The estimated fair values of the natural gas derivatives were determined using future natural gas index prices (as

more fully described below). The Company has master netting arrangements with each counterparty that provide

for the net settlement (in the settlement month) of all contracts through a single payment. As applicable, the

Company has elected to reflect the net amounts in its balance sheets. The Company had no outstanding collateral

associated with the Swaps during either period shown in the above table.

Southwest Gas Corporation