Page 78 - SWGas Annual Report 2015

P. 78

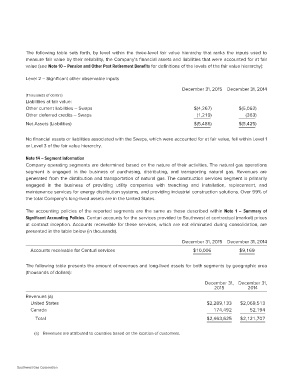

The following table sets forth, by level within the three-level fair value hierarchy that ranks the inputs used to

measure fair value by their reliability, the Company’s financial assets and liabilities that were accounted for at fair

value (see Note 10 – Pension and Other Post Retirement Benefits for definitions of the levels of the fair value hierarchy):

Level 2 – Significant other observable inputs December 31, 2015 December 31, 2014

(Thousands of dollars) $(4,267) $(5,062)

(1,219) (363)

Liabilities at fair value:

Other current liabilities – Swaps $(5,486) $(5,425)

Other deferred credits – Swaps

Net Assets (Liabilities)

No financial assets or liabilities associated with the Swaps, which were accounted for at fair value, fell within Level 1

or Level 3 of the fair value hierarchy.

Note 14 – Segment Information

Company operating segments are determined based on the nature of their activities. The natural gas operations

segment is engaged in the business of purchasing, distributing, and transporting natural gas. Revenues are

generated from the distribution and transportation of natural gas. The construction services segment is primarily

engaged in the business of providing utility companies with trenching and installation, replacement, and

maintenance services for energy distribution systems, and providing industrial construction solutions. Over 99% of

the total Company’s long-lived assets are in the United States.

The accounting policies of the reported segments are the same as those described within Note 1 – Summary of

Significant Accounting Policies. Centuri accounts for the services provided to Southwest at contractual (market) prices

at contract inception. Accounts receivable for these services, which are not eliminated during consolidation, are

presented in the table below (in thousands).

December 31, 2015 December 31, 2014

Accounts receivable for Centuri services $10,006 $9,169

The following table presents the amount of revenues and long-lived assets for both segments by geographic area

(thousands of dollars):

December 31, December 31,

2015 2014

Revenues (a) $2,289,133 $2,069,513

United States 174,492 52,194

Canada

$2,463,625 $2,121,707

Total

(a) Revenues are attributed to countries based on the location of customers.

Southwest Gas Corporation