Page 73 - SWGas Annual Report 2015

P. 73

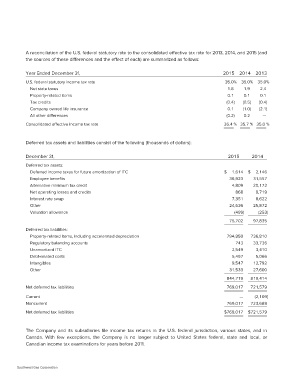

A reconciliation of the U.S. federal statutory rate to the consolidated effective tax rate for 2013, 2014, and 2015 (and

the sources of these differences and the effect of each) are summarized as follows:

Year Ended December 31, 2015 2014 2013

U.S. federal statutory income tax rate 35.0% 35.0% 35.0%

Net state taxes 1.8 1.9 2.4

Property-related items 0.1 0.1 0.1

Tax credits (0.4) (0.5) (0.4)

Company owned life insurance 0.1 (1.0) (2.1)

All other differences (0.2) 0.2 —

Consolidated effective income tax rate 36.4 % 35.7 % 35.0 %

Deferred tax assets and liabilities consist of the following (thousands of dollars): 2015 2014

December 31, $ 1,614 $ 2,146

Deferred tax assets:

36,923 31,557

Deferred income taxes for future amortization of ITC

Employee benefits 4,809 20,172

Alternative minimum tax credit

Net operating losses and credits 868 9,719

Interest rate swap

Other 7,351 8,622

Valuation allowance

24,636 25,872

Deferred tax liabilities:

Property-related items, including accelerated depreciation (499) (253)

Regulatory balancing accounts

Unamortized ITC 75,702 97,835

Debt-related costs

Intangibles 794,850 736,810

Other 743 33,736

3,410

Net deferred tax liabilities 2,549 5,066

5,497 12,792

Current 9,547 27,600

Noncurrent 31,533

Net deferred tax liabilities 819,414

844,719

721,579

769,017

— (2,109)

769,017 723,688

$769,017 $721,579

The Company and its subsidiaries file income tax returns in the U.S. federal jurisdiction, various states, and in

Canada. With few exceptions, the Company is no longer subject to United States federal, state and local, or

Canadian income tax examinations for years before 2011.

Southwest Gas Corporation