Page 71 - SWGas Annual Report 2015

P. 71

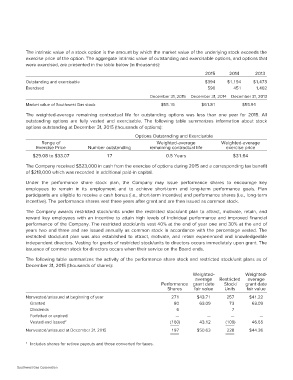

The intrinsic value of a stock option is the amount by which the market value of the underlying stock exceeds the

exercise price of the option. The aggregate intrinsic value of outstanding and exercisable options, and options that

were exercised, are presented in the table below (in thousands):

2015 2014 2013

Outstanding and exercisable $394 $1,194 $1,473

Exercised 590 451 1,402

December 31, 2015 December 31, 2014 December 31, 2013

Market value of Southwest Gas stock $55.16 $61.81 $55.91

The weighted-average remaining contractual life for outstanding options was less than one year for 2015. All

outstanding options are fully vested and exercisable. The following table summarizes information about stock

options outstanding at December 31, 2015 (thousands of options):

Options Outstanding and Exercisable

Range of Number outstanding Weighted-average Weighted-average

Exercise Price remaining contractual life exercise price

$29.08 to $33.07 17 0.5 Years $31.64

The Company received $523,000 in cash from the exercise of options during 2015 and a corresponding tax benefit

of $218,000 which was recorded in additional paid-in capital.

Under the performance share stock plan, the Company may issue performance shares to encourage key

employees to remain in its employment and to achieve short-term and long-term performance goals. Plan

participants are eligible to receive a cash bonus (i.e., short-term incentive) and performance shares (i.e., long-term

incentive). The performance shares vest three years after grant and are then issued as common stock.

The Company awards restricted stock/units under the restricted stock/unit plan to attract, motivate, retain, and

reward key employees with an incentive to attain high levels of individual performance and improved financial

performance of the Company. The restricted stock/units vest 40% at the end of year one and 30% at the end of

years two and three and are issued annually as common stock in accordance with the percentage vested. The

restricted stock/unit plan was also established to attract, motivate, and retain experienced and knowledgeable

independent directors. Vesting for grants of restricted stock/units to directors occurs immediately upon grant. The

issuance of common stock for directors occurs when their service on the Board ends.

The following table summarizes the activity of the performance share stock and restricted stock/unit plans as of

December 31, 2015 (thousands of shares):

Weighted- Weighted-

average Restricted average

Performance grant date Stock/ grant date

Shares fair value Units fair value

Nonvested/unissued at beginning of year 271 $43.71 257 $41.22

Granted 80 63.09 73 63.09

Dividends 6 7

Forfeited or expired — — — —

Vested and issued* 43.12 46.65

(160) (109)

Nonvested/unissued at December 31, 2015 197 $50.63 228 $44.36

* Includes shares for retiree payouts and those converted for taxes.

Southwest Gas Corporation