Page 70 - SWGas Annual Report 2015

P. 70

this update, the commingled equity funds are no longer included in the above fair value hierarchy table as a

Level 3 fair value measurement but instead are disclosed as a reconciling item to the table. The associated

Fair Value Measurement Using Significant Unobservable Inputs (Level 3) table is no longer presented due to

this change, as the commingled equity funds were the only assets whose values were previously indicated to

be Level 3 fair value measurements.

(4) The insurance company general account contracts are annuity insurance contracts used to pay the pensions of

employees who retired prior to 1989. The balance of the account disclosed in the above table is the contract

value, which is the result of deposits, withdrawals, and interest credits.

(5) The assets in the above table exceed the market value of plan assets shown in the funded status table by

$2,859,000 (qualified retirement plan – $2,803,000, PBOP – $56,000) and $8,572,000 (qualified retirement

plan – $8,312,000, PBOP – $260,000) for 2015 and 2014, respectively, which includes a payable for securities

purchased, partially offset by receivables for interest, dividends, and securities sold.

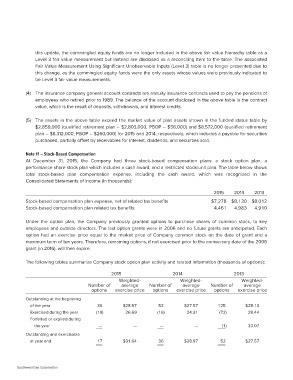

Note 11 – Stock-Based Compensation

At December 31, 2015, the Company had three stock-based compensation plans: a stock option plan, a

performance share stock plan which includes a cash award, and a restricted stock/unit plan. The table below shows

total stock-based plan compensation expense, including the cash award, which was recognized in the

Consolidated Statements of Income (in thousands):

Stock-based compensation plan expense, net of related tax benefits 2015 2014 2013

Stock-based compensation plan related tax benefits

$7,278 $8,130 $8,012

4,461 4,983 4,910

Under the option plan, the Company previously granted options to purchase shares of common stock, to key

employees and outside directors. The last option grants were in 2006 and no future grants are anticipated. Each

option had an exercise price equal to the market price of Company common stock on the date of grant and a

maximum term of ten years. Therefore, remaining options, if not exercised prior to the anniversary date of the 2006

grant (in 2016), will then expire.

The following tables summarize Company stock option plan activity and related information (thousands of options):

2015 2014 2013

Weighted- Weighted- Weighted-

Number of average Number of average Number of average

options exercise price options exercise price options exercise price

Outstanding at the beginning 36 $28.97 52 $27.57 125 $28.13

of the year (19) 26.69 (16) 24.31 (72) 28.44

Exercised during the year

Forfeited or expired during —— —— (1) 33.07

the year

17 $31.64 36 $28.97 52 $27.57

Outstanding and exercisable

at year end

Southwest Gas Corporation