Page 55 - SWGas Annual Report 2015

P. 55

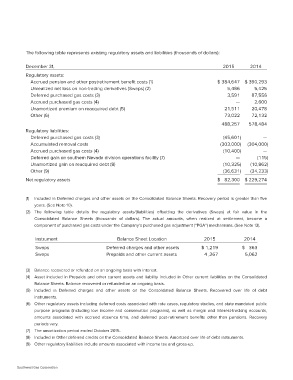

The following table represents existing regulatory assets and liabilities (thousands of dollars):

December 31, 2015 2014

Regulatory assets: $ 384,647 $ 390,293

Accrued pension and other postretirement benefit costs (1) 5,486 5,425

Unrealized net loss on non-trading derivatives (Swaps) (2) 3,591

Deferred purchased gas costs (3) — 87,556

Accrued purchased gas costs (4) 2,600

Unamortized premium on reacquired debt (5) 21,511

Other (6) 73,022 20,478

72,132

Regulatory liabilities:

Deferred purchased gas costs (3) 488,257 578,484

Accumulated removal costs

Accrued purchased gas costs (4) (45,601) —

Deferred gain on southern Nevada division operations facility (7) (303,000) (304,000)

Unamortized gain on reacquired debt (8)

Other (9) (10,400) —

— (115)

Net regulatory assets (10,862)

(10,325) (34,233)

(36,631)

$ 82,300 $ 229,274

(1) Included in Deferred charges and other assets on the Consolidated Balance Sheets. Recovery period is greater than five

years. (See Note 10).

(2) The following table details the regulatory assets/(liabilities) offsetting the derivatives (Swaps) at fair value in the

Consolidated Balance Sheets (thousands of dollars). The actual amounts, when realized at settlement, become a

component of purchased gas costs under the Company’s purchased gas adjustment (“PGA”) mechanisms. (See Note 13).

Instrument Balance Sheet Location 2015 2014

Swaps Deferred charges and other assets $ 1,219 $ 363

Swaps Prepaids and other current assets 4 ,267 5,062

(3) Balance recovered or refunded on an ongoing basis with interest.

(4) Asset included in Prepaids and other current assets and liability included in Other current liabilities on the Consolidated

Balance Sheets. Balance recovered or refunded on an ongoing basis.

(5) Included in Deferred charges and other assets on the Consolidated Balance Sheets. Recovered over life of debt

instruments.

(6) Other regulatory assets including deferred costs associated with rate cases, regulatory studies, and state mandated public

purpose programs (including low income and conservation programs), as well as margin and interest-tracking accounts,

amounts associated with accrued absence time, and deferred post-retirement benefits other than pensions. Recovery

periods vary.

(7) The amortization period ended October 2015.

(8) Included in Other deferred credits on the Consolidated Balance Sheets. Amortized over life of debt instruments.

(9) Other regulatory liabilities include amounts associated with income tax and gross-up.

Southwest Gas Corporation