Page 59 - SWGas Annual Report 2015

P. 59

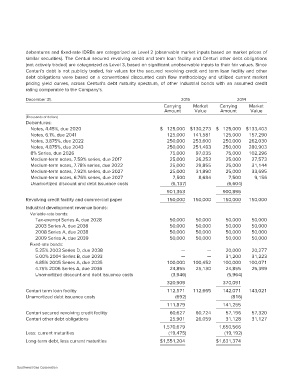

debentures and fixed-rate IDRBs are categorized as Level 2 (observable market inputs based on market prices of

similar securities). The Centuri secured revolving credit and term loan facility and Centuri other debt obligations

(not actively traded) are categorized as Level 3, based on significant unobservable inputs to their fair values. Since

Centuri’s debt is not publicly traded, fair values for the secured revolving credit and term loan facility and other

debt obligations were based on a conventional discounted cash flow methodology and utilized current market

pricing yield curves, across Centuri’s debt maturity spectrum, of other industrial bonds with an assumed credit

rating comparable to the Company’s.

December 31, 2015 2014

(Thousands of dollars) Carrying Market Carrying Market

Amount Value Amount Value

Debentures:

Notes, 4.45%, due 2020 $ 125,000 $130,273 $ 125,000 $133,403

Notes, 6.1%, due 2041

Notes, 3.875%, due 2022 125,000 141,581 125,000 157,290

Notes, 4.875%, due 2043

8% Series, due 2026 250,000 253,600 250,000 262,030

Medium-term notes, 7.59% series, due 2017

Medium-term notes, 7.78% series, due 2022 250,000 251,483 250,000 280,903

Medium-term notes, 7.92% series, due 2027

Medium-term notes, 6.76% series, due 2027 75,000 97,035 75,000 102,296

Unamortized discount and debt issuance costs

25,000 26,253 25,000 27,573

Revolving credit facility and commercial paper

Industrial development revenue bonds: 25,000 29,855 25,000 31,144

Variable-rate bonds: 25,000 31,890 25,000 33,695

Tax-exempt Series A, due 2028

2003 Series A, due 2038 7,500 8,684 7,500 9,156

2008 Series A, due 2038

2009 Series A, due 2039 (6,137) (6,604)

Fixed-rate bonds: 901,363 900,896

5.25% 2003 Series D, due 2038

5.00% 2004 Series B, due 2033 150,000 150,000 150,000 150,000

4.85% 2005 Series A, due 2035

4.75% 2006 Series A, due 2036 50,000 50,000 50,000 50,000

Unamortized discount and debt issuance costs 50,000 50,000 50,000 50,000

50,000 50,000 50,000 50,000

Centuri term loan facility 50,000 50,000 50,000 50,000

Unamortized debt issuance costs

— — 20,000 20,277

Centuri secured revolving credit facility — — 31,200 31,223

Centuri other debt obligations 100,000 100,452 100,000 100,071

24,855 25,130 24,855 25,399

Less: current maturities (3,946) (5,964)

Long-term debt, less current maturities 143,021

320,909 370,091

57,320

112,571 112,665 142,071 31,127

(692) (816)

111,879 141,255

60,627 60,724 57,196

25,901 26,059 31,128

1,570,679 1,650,566

(19,475) (19,192)

$1,551,204 $1,631,374

Southwest Gas Corporation