Page 63 - SWGas Annual Report 2015

P. 63

Southwest has a deferred compensation plan for all officers and a separate deferred compensation plan for

members of the Board of Directors. The plans provide the opportunity to defer up to 100% of annual cash

compensation. Southwest matches one-half of amounts deferred by officers, up to a maximum matching

contribution of 3.5% of an officer’s annual base salary. Upon retirement, payments of compensation deferred, plus

interest, are made in equal monthly installments over 10, 15, or 20 years, as elected by the participant. Directors

have an additional option to receive such payments over a five-year period. Deferred compensation earns interest

at a rate determined each January. The interest rate equals 150% of Moody’s Seasoned Corporate Bond Rate

Index.

Southwest has a noncontributory qualified retirement plan with defined benefits covering substantially all

employees and a separate unfunded supplemental executive retirement plan (“SERP”) which is limited to officers.

Southwest also provides postretirement benefits other than pensions (“PBOP”) to its qualified retirees for health

care, dental, and life insurance benefits.

The Company recognizes the overfunded or underfunded positions of defined benefit postretirement plans,

including pension plans, in its Consolidated Balance Sheets. Any actuarial gains and losses, prior service costs and

transition assets or obligations are recognized in Accumulated other comprehensive income under Stockholders’

equity, net of tax, until they are amortized as a component of net periodic benefit cost.

The Company has established a regulatory asset for the portion of the total amounts otherwise chargeable to

accumulated other comprehensive income that are expected to be recovered through rates in future periods.

Changes in actuarial gains and losses and prior service costs pertaining to the regulatory asset will be recognized

as an adjustment to the regulatory asset account as these amounts are amortized and recognized as components

of net periodic pension costs each year.

Investment objectives and strategies for the qualified retirement plan are developed and approved by the Pension

Plan Investment Committee of the Board of Directors of the Company. They are designed to enhance capital,

maintain minimum liquidity required for retirement plan operations and effectively manage pension assets.

A target portfolio of investments in the qualified retirement plan is developed by the Pension Plan Investment

Committee and is reevaluated periodically. Asset return assumptions are determined by evaluating performance

expectations of the target portfolio. Projected benefit obligations are estimated using actuarial assumptions and

Company benefit policy. A target mix of assets is then determined based on acceptable risk versus estimated

returns in order to fund the benefit obligation. At December 31, 2015, the percentage ranges of the target portfolio

are:

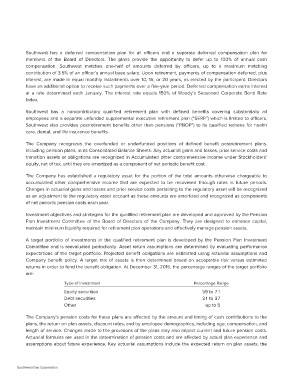

Type of Investment Percentage Range

Equity securities 59 to 71

Debt securities 31 to 37

Other

up to 5

The Company’s pension costs for these plans are affected by the amount and timing of cash contributions to the

plans, the return on plan assets, discount rates, and by employee demographics, including age, compensation, and

length of service. Changes made to the provisions of the plans may also impact current and future pension costs.

Actuarial formulas are used in the determination of pension costs and are affected by actual plan experience and

assumptions about future experience. Key actuarial assumptions include the expected return on plan assets, the

Southwest Gas Corporation