Page 58 - SWGas Annual Report 2015

P. 58

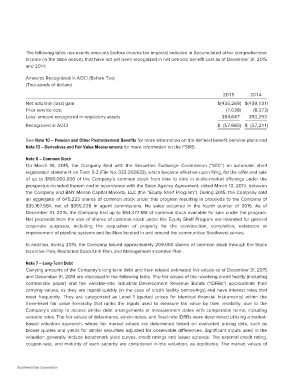

The following table represents amounts (before income tax impacts) included in Accumulated other comprehensive

income (in the table above), that have not yet been recognized in net periodic benefit cost as of December 31, 2015

and 2014:

Amounts Recognized in AOCI (Before Tax) 2015 2014

(Thousands of dollars)

$(435,269) $(439,131)

Net actuarial (loss) gain (7,038) (8,373)

Prior service cost

Less: amount recognized in regulatory assets 384,647 390,293

Recognized in AOCI

$ (57,660) $ (57,211)

See Note 10 – Pension and Other Postretirement Benefits for more information on the defined benefit pension plans and

Note 13 – Derivatives and Fair Value Measurements for more information on the FSIRS.

Note 6 – Common Stock

On March 10, 2015, the Company filed with the Securities Exchange Commission (“SEC”) an automatic shelf

registration statement on Form S-3 (File No. 333-202633), which became effective upon filing, for the offer and sale

of up to $100,000,000 of the Company’s common stock from time to time in at-the-market offerings under the

prospectus included therein and in accordance with the Sales Agency Agreement, dated March 10, 2015, between

the Company and BNY Mellon Capital Markets, LLC (the “Equity Shelf Program”). During 2015, the Company sold

an aggregate of 645,225 shares of common stock under this program resulting in proceeds to the Company of

$35,167,584, net of $355,228 in agent commissions. No sales occurred in the fourth quarter of 2015. As of

December 31, 2015, the Company had up to $64,477,188 of common stock available for sale under the program.

Net proceeds from the sale of shares of common stock under the Equity Shelf Program are intended for general

corporate purposes, including the acquisition of property for the construction, completion, extension or

improvement of pipeline systems and facilities located in and around the communities Southwest serves.

In addition, during 2015, the Company issued approximately 209,000 shares of common stock through the Stock

Incentive Plan, Restricted Stock/Unit Plan, and Management Incentive Plan.

Note 7 – Long-Term Debt

Carrying amounts of the Company’s long-term debt and their related estimated fair values as of December 31, 2015

and December 31, 2014 are disclosed in the following table. The fair values of the revolving credit facility (including

commercial paper) and the variable-rate Industrial Development Revenue Bonds (“IDRBs”) approximate their

carrying values, as they are repaid quickly (in the case of credit facility borrowings) and have interest rates that

reset frequently. They are categorized as Level 1 (quoted prices for identical financial instruments) within the

three-level fair value hierarchy that ranks the inputs used to measure fair value by their reliability, due to the

Company’s ability to access similar debt arrangements at measurement dates with comparable terms, including

variable rates. The fair values of debentures, senior notes, and fixed-rate IDRBs were determined utilizing a market-

based valuation approach, where fair market values are determined based on evaluated pricing data, such as

broker quotes and yields for similar securities adjusted for observable differences. Significant inputs used in the

valuation generally include benchmark yield curves, credit ratings and issuer spreads. The external credit rating,

coupon rate, and maturity of each security are considered in the valuation, as applicable. The market values of

Southwest Gas Corporation